A debit invoice is provided when a seller needs to increase the amount owed by the client. This accounting document is used when an hourly rate was quoted, but the job took longer to complete than originally estimated. Sales invoices are crucial documentation for verifying claims made on tax returns.

- Let’s say you’re a photographer who’s snapped some wedding photos, leaving a pair of happy customers in your wake.

- If you prefer, you can set up default terms and notes which will print on every invoice you create.

- It will be identical to the source invoice, including the issue date.

- You can also use Smart Docs, Pipedrive’s sales document creation and management platform, to create invoice templates and track contact interaction with them.

Purchase orders are created and sent by buyers to the seller to officially request goods or services and track the delivery and payment process. Sales invoices, on the other hand, are created by the seller and sent to the buyer once the service has been completed or the good has been obtained by the customer. A proforma invoice is a sales invoice that is issued before the goods or services are provided. Proforma invoices are typically used to confirm an order or to request payment in advance.

What is the difference between a sales invoice and a purchase invoice?

Including the customer’s contact information on your sales invoice helps establish a clear communication point and ensure that the invoice is delivered to the correct person. This information should include the customer’s name, company name (if applicable), address, phone number, and email. In case when a business sells physical products, issuing sales invoices is equally important in managing inventory. Keep in mind that if your client is a large company, your point of contact for payment might not be your standard contact. If you’re using a template, make sure the template includes all the fields you need.

While you can certainly go the route of drafting simple invoices in a word processor or spreadsheet, using a customizable template is less of a headache. You can even select templates in common software programs like Microsoft or Google Suite. An invoice is proof from the seller that a product or service has been provided, and it is a request for payment from the buyer.

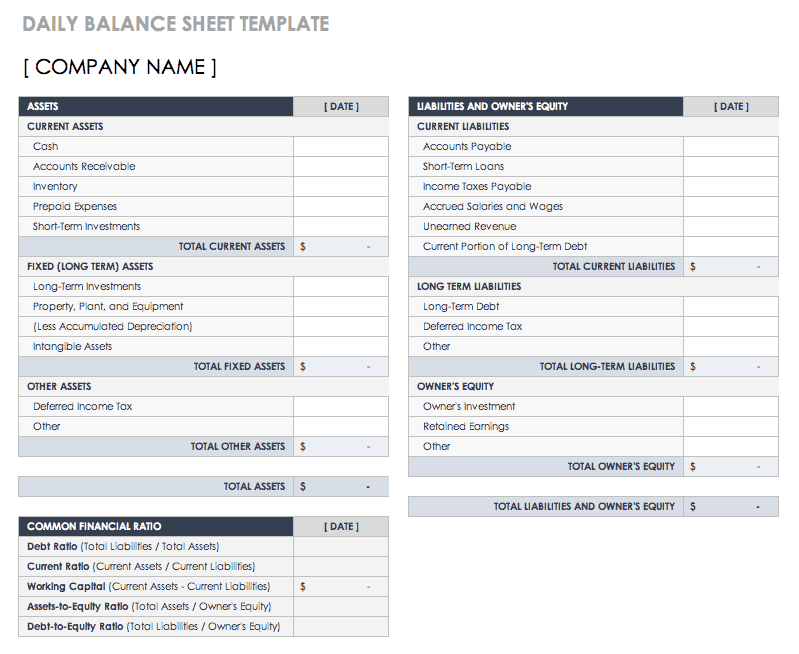

The total should be broken out into subtotal (the total cost for the products or services), plus line items for any additional taxes and fees. Sales orders are similar to sales invoices in that they are both generated by the sales rep; sales invoices, however, enter the process after sales orders. For that, you need to focus on creating an impactful reference specific sales invoices template that works best for your business. Every business is different in many ways and performs various tasks, and services, and sells a variety of products. Each of them needs to be professional whenever it comes to client communication. There are several ways businesses need to communicate with the clients, and one of them is “Invoicing” which is a very important element for getting paid.

Tax rates

Invoices create legally binding agreements between companies and buyers, especially for larger purchases. As a small business owner you need smart ways to reduce your admin time, and make sure you get paid quickly. Grab our free general sales invoice template to see how easy billing can be. Populate the template, add your preferred payment details – and get paid into your Wise Business account to cut the costs of selling to international clients. Sales invoice and sales order are sales documents at different phases of the sale cycle.

- Sales invoice and sales order are sales documents at different phases of the sale cycle.

- Often you will have standard item descriptions and inventory numbers, but the more specific and detailed as possible, the better.

- With its help, the purchaser confirms the obligation to pay for services or products provided with this document.

- Your description should be detailed enough for clarity but brief enough to avoid page clutter.

The purpose of sales invoices important is to feature every single detail about the services businesses have provided to the client. These types of commercial invoices are used to create a compulsion for paying a debt for the goods or services the client has availed. A sales invoice, on the other hand, is created by the vendor or seller after they have delivered their products and services to the company or customer.

Payment Due Date

Click on “Add adjustments” to add adjustments such as a discount, value-added tax (VAT), or a fee. You’ll need the infrastructure to accept each method you offer, so consider what’s feasible and cost-effective for your business. Make it clear that you (or someone on your accounting team) are on hand to answer questions, too. If a buyer has concerns and doesn’t know how to raise them, they might turn their attention to another task and cause a delay. Address your recipient by name and use the same tone as you would in any other correspondence with that customer. People like doing business with people, not robots, and small touches like this go a long way towards relationship building.

BIR may exempt small farmers from receipt, invoice requirement – BusinessWorld Online

BIR may exempt small farmers from receipt, invoice requirement.

Posted: Wed, 09 Aug 2023 07:00:00 GMT [source]

A sales invoice is a document sent to a purchaser by a product or service provider. It establishes an obligation on the part of the purchaser to pay and serves as proof of the debt. Invoices are essential for many businesses, but it’s virtually mandatory for any company dealing with a supply chain or offering services without payment needed upfront. This document allows them to order the products they want to purchase — and prepay for them.

How to Edit a Filemaker Invoice

For the buyer, it provides a record of what was purchased and when. For the seller, it provides a record of what was sold and how much money was exchanged. Sales invoices also provide a way to track payments for accounting purposes.

You can simply lose the needed document and then spend hours looking for it. Here are the top 5 recommendations for improving your sales invoicing. You can follow all of them or start with just one recommendation.

If you email the invoice to your customer, they can see the files you’ve attached. For example, if you set up departments for each of your sales regions, you can apply those departments when you create invoices. Later, you can produce reports that show invoices for each region.

At smaller companies, the accounting department may be collectively responsible. Try to get in touch directly with the person who pulls the purse strings (and don’t forget to CC your contact). Payment terms should also include information about acceptable ways to pay, to whom to write checks, and what to expect if payment is not on time. Sales voices are often misnomered among their other sales transaction document counterparts.

Once you’ve set analysis tags up, you can assign them when you create your invoices. You can then produce reports using these tags, helping you to review your sales in more detail. If you add a product or service to the invoice, the ledger account is taken from the one saved on the product or service record. Just enter text such as ‘No address’ or ‘TBC’ into the address fields in order to create and save your invoice. You can edit the address on the customer’s record later, if you need to. The delivery address on your invoice populates from the customer record you select.

Step 3: Number and date each invoice

That’s why so many businesses have turned to solutions like Close. Sales invoices help both parties to understand what’s being bought, sold, and provided. They provide a legal document that details the transaction and terms under which sales occur. Companies need to make sure invoices include pertinent information and are accurate. Also included on the invoice should be the contact names of the two parties and their addresses.

Men sentenced over fake cranberry sauce sales – BBC

Men sentenced over fake cranberry sauce sales.

Posted: Mon, 24 Jul 2023 07:00:00 GMT [source]

Here are six ways to streamline your invoicing process for faster payments and happier customers. VAT options like reverse charge, EC rate, standard tax, or even margin VAT are essential to provide. This information must be filed with the IRS, so you should be specific about it. It’s better to use software that calculates the taxes, so you don’t need to do it manually. Invoices have their perfect time for sending, which is immediately after you provide services or sell the product.

When you create an invoice, the default set on the customer record is used first. This is to help you make sure the right ledger account is used on your Sales invoices automatically. After delivering a product or service, a company will create an invoice containing all details of the transaction and payment expectations. To begin, it’s important to note the date the invoice was created because it ensures both parties know when the payment is due.